Should You Buy or Sell Disney (DIS) Stock NOW

Is This the right time to invest in Disney Stock, here is DIS analysis after earnings report.

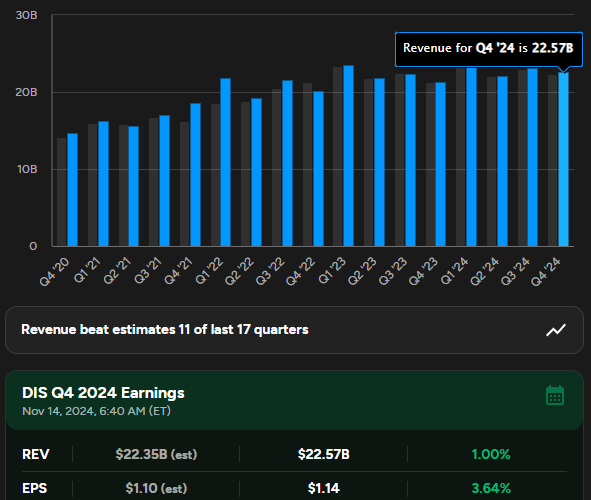

Walt Disney Company recently released its earnings report for the fourth quarter and full fiscal year 2024. The company showcased strong performance across its various segments, driven by strategic innovations and robust consumer demand.

Disney Reports Strong Q4 and Full-Year Results

The Walt Disney Company today announced its financial results for the fourth quarter and full year of fiscal 2024. The company delivered strong performance across its various segments, driven by a combination of strategic initiatives and robust consumer demand.

Key Highlights:

Revenue: Increased 6% for Q4 to $22.6 billion and 3% for the full year to $91.4 billion.

Income Before Income Taxes: Declined 6% to $0.9 billion in Q4 and increased 59% for the full year to $7.6 billion.

Diluted EPS: Increased 79% to $0.25 in Q4 and more than doubled to $2.72 for the full year.

Revenue and Earnings for Q4 2024

Segment Performance:

Entertainment: Strong performance driven by successful theatrical releases like Inside Out 2 and Deadpool & Wolverine.

Sports: Continued growth in domestic ESPN advertising revenue.

Experiences: Record revenue and operating income for the full year, with strong performance in domestic parks and experiences.

Guidance and Outlook:

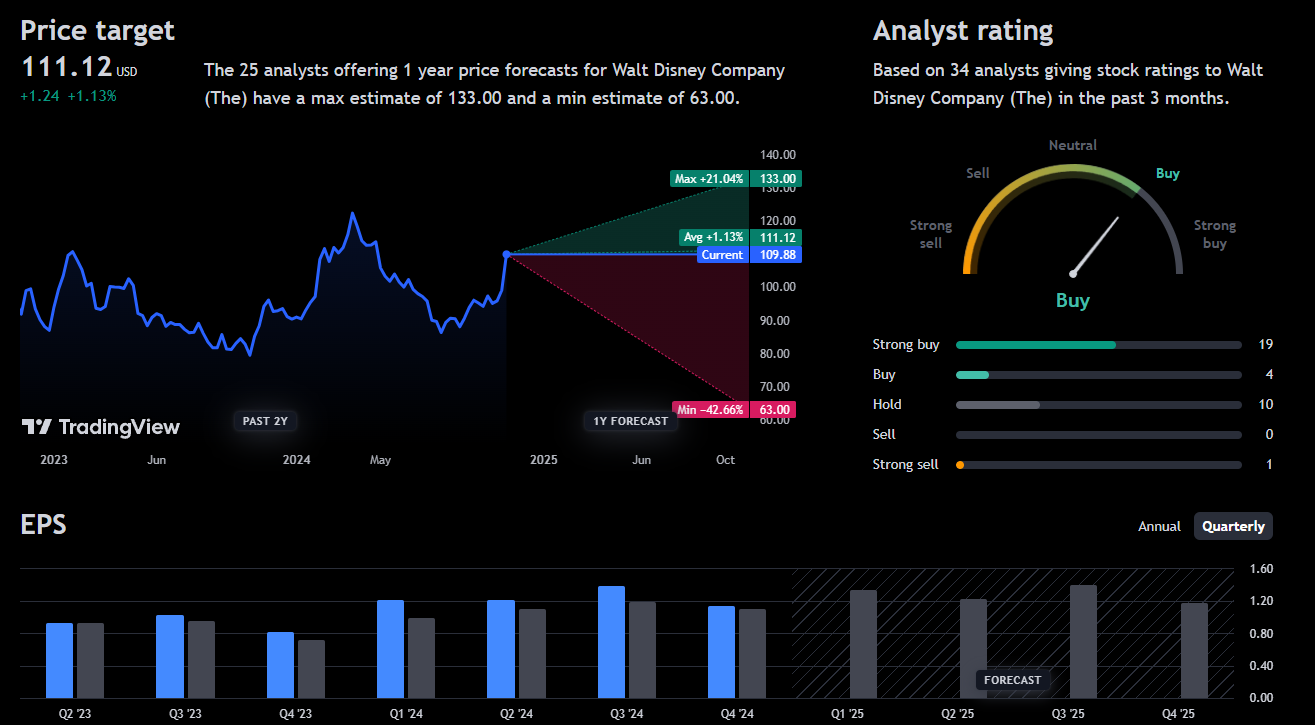

Disney is optimistic about its future growth prospects and has provided guidance for fiscal 2025 and 2026, including:

High-single-digit adjusted EPS growth for fiscal 2025.

Double-digit adjusted EPS growth for fiscal 2026.

Continued focus on improving profitability in its streaming businesses.

CEO Robert A. Iger expressed satisfaction with the company's performance and highlighted the strategic efforts to enhance quality, innovation, efficiency, and value creation. He emphasized the company's strong position in the industry and its commitment to delivering exceptional entertainment experiences to consumers.

For more detailed information and analysis, please refer to the full earnings release. Click here

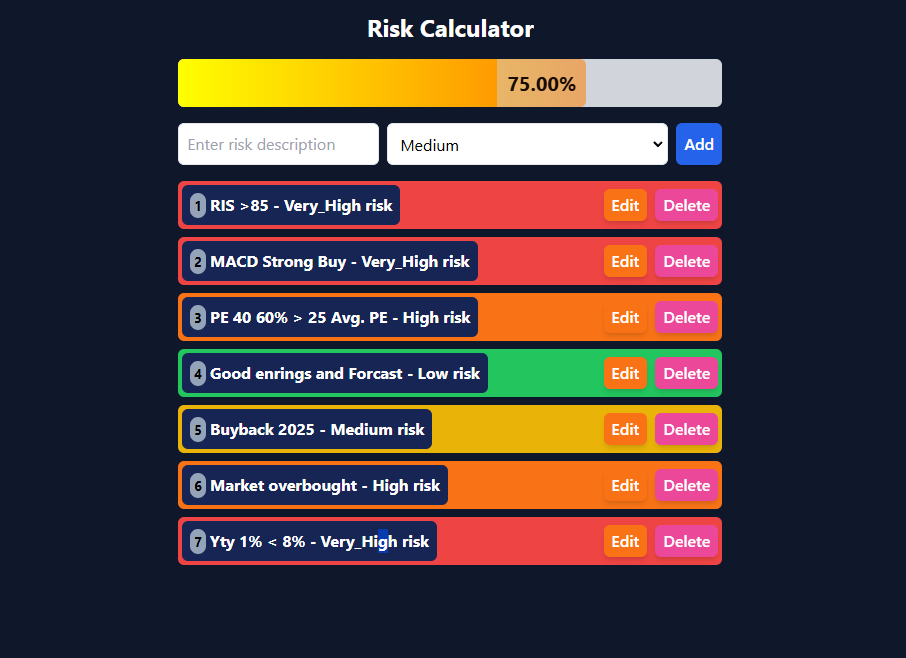

Technical Analysis and Risk Assessment:

While Disney's recent earnings report was positive, a technical analysis reveals a potential overbought condition. The RSI is currently over 80, indicating a high-risk level. Additionally, the PE ratio is 60% above the average, further contributing to the risk assessment.

Conclusion:

Despite the strong earnings report and optimistic outlook, the current market conditions and technical indicators suggest a cautious approach to Disney stock. While the company's long-term prospects remain promising, the short-term risks associated with the overbought market and high valuation warrant careful consideration.

Disclaimer: This analysis is not financial advice. Please consult with a financial advisor before making any investment decisions.