In this blog post, I’m breaking down the latest market news, geopolitical shifts, economic data, and my updated portfolio strategy including high-conviction stocks like Visa, Apple, AMD, Mastercard, and more. Plus, I’ll share key earnings takeaways and how I’m trading oil and bonds right now.

📰 Market Recap

The S&P 500, Nasdaq, and Dow Jones all hit new all-time highs as geopolitical tensions eased and trade optimism resurged. Major catalysts include:

Ceasefire between Iran & Israel

Reports of potential trade deals with China and India

Dovish Fed comments and high expectations of rate cuts

Explosive performance in AI and tech sectors (e.g. Nvidia, Oracle)

📊 Index Weekly Performance:

S&P 500: +3.4%

Nasdaq: +4.25%

Dow Jones: +3.8%

🛢️ Oil Trade Breakdown

Tensions in the Middle East initially drove oil prices higher, but once de-escalation occurred, WTI crude dropped 13% to ~$65/barrel.

💼 My Trade:

Bought a short on WTI on Monday (sold shortly after)

Target buy range: $55–$60/barrel

Preferred oil stock: Exxon Mobil (XOM) – decent dividend but still waiting for better technicals

💰 Economic Data & Fed Outlook

Core PCE inflation rose slightly

Consumer inflation expectations dropped

Durable goods orders surged (especially aircraft)

Fed rate cut probability: 92% chance by September

📉 Rate cuts would boost borrowing and market momentum.

📊 Earnings & Stock Picks

✅ Nike (NKE)

Popped +20% on solid earnings

MACD shows buy signal, RSI overbought

Exiting this small position in my portfolio

🆕 Circle IPO

Small starter position: 0.85% of my portfolio

Down ~18%

Watching for a potential re-entry after summer correction

💳 Mastercard (MA) & Visa (V)

Re-entered Visa after its June breakout

Bought 7 shares of MA at $468

Bullish on both companies for the long term

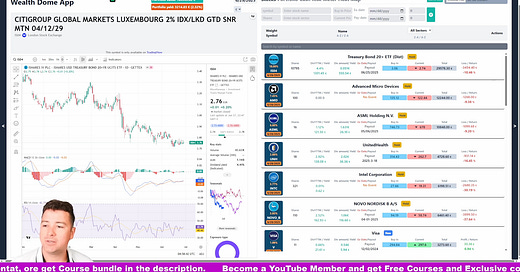

📈 Portfolio Highlights

StockPosition %NotesLong-Term Bonds12%Waiting for rate cuts; yield ~4.31%Apple (AAPL)11.5%Expecting late-year rallyAMD9.3%Down currently, strong long-term playASML–Monopoly in lithography chipsGoogle (GOOG)–Bullish on AI + Gemini rolloutNovo Nordisk–Still holding; litigation ongoingUnitedHealth–Down but potential 30%+ annual returnBerkshire Hathaway–Long-term conviction buy

🧪 Watchlist

Intel – Potential acquisition target

Realty Income (O) – Oversold, watching for bounce

Truist Financial (TFC) – Will exit on RSI overbought

Share this post