Intel's stock surged over 10% in a day, Hims & Hers skyrocketed 27%, and CVS finally made a comeback! In this week’s market recap, I break down key earnings, portfolio updates, and my 40% risk assessment for the coming week. Should you buy, hold, or sell these stocks? Let’s dive in!

🔹 Intel’s big move—can it sustain the rally?

🔹 Hims & Hers explodes after Super Bowl ad—overhyped or a buy?

🔹 CVS rebounds—strong earnings or just temporary momentum?

🔹 Portfolio updates: Why I sold Nvidia, Oracle, and Palo Alto Networks!

Don’t forget to like, comment, and subscribe for more in-depth stock market insights!

#StockMarketUpdate #Investing #IntelStock

💰 Weekly Market Recap & Portfolio Update (Feb 10 - Feb 14, 2025)

February brought volatility, breakouts, and key earnings that shook the market. I’ll go over the biggest stock moves, portfolio changes, and a risk assessment to help navigate the upcoming week.

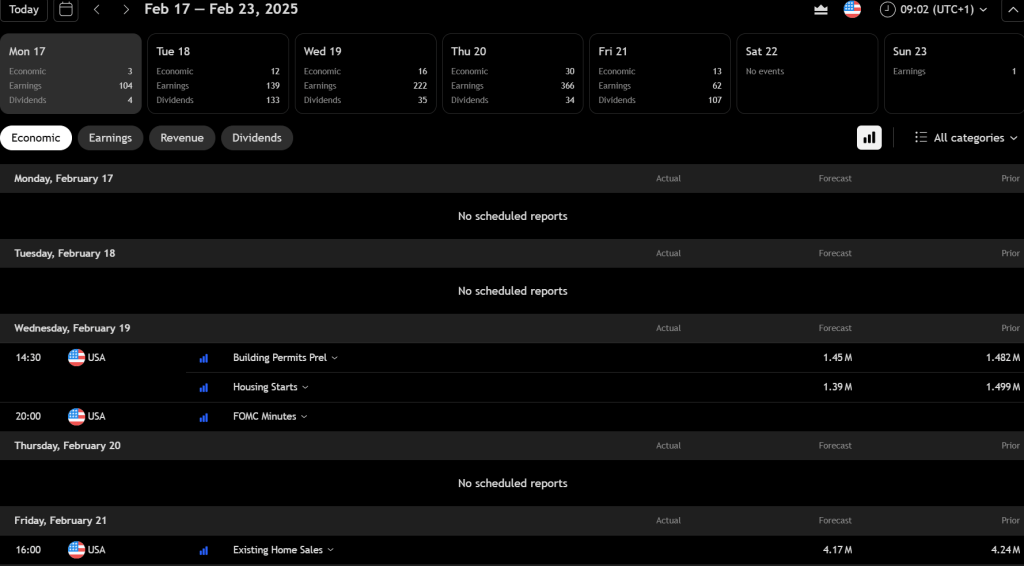

Next weeks earnings

🔥 1. Intel (INTC) — Government Support Sparks 10% Surge!

📉 Ticker: INTC

💰 Current Price: ~$44.50

📈 Weekly Gain: +10.2%

Intel had a monster week, rallying over 10% in a single day, fueled by:

✅ US Government backing domestic semiconductor manufacturing

✅ Rumors of a joint venture with TSMC

✅ Intel’s turnaround efforts gaining traction

Despite the surge, Intel still faces massive competition from NVIDIA (NVDA) and AMD (AMD). I’m still holding my shares but watching carefully—this could be a short-term hype rally.

🚀 2. Hims & Hers (HIMS) — Super Bowl Ad Sends Stock Up 27%!

📉 Ticker: HIMS

💰 Current Price: ~$18.25

📈 Weekly Gain: +27%

Hims & Hers stock exploded this week, following a massive Super Bowl ad campaign that put them on the radar of new investors.

📌 Why the rally?

✅ Subscription-based revenue growth (steady recurring income)

✅ Massive marketing boost from the Super Bowl

✅ Analyst upgrades & bullish sentiment

⚠ BUT... is it overvalued?

While the stock is on fire, the RSI is flashing overbought signals, so I sold my position for a quick trade. If it pulls back, I might re-enter.

💊 3. CVS Health (CVS) — Finally a Breakout!

📉 Ticker: CVS

💰 Current Price: ~$73.40

📈 Weekly Gain: +5%

After two years of pain, CVS finally broke out, thanks to:

✔ Strong Q4 earnings & raised 2025 guidance

✔ Solid 4.2% revenue growth YoY

✔ Improving fundamentals & dividend stability (4% yield)

I’m long on CVS, and my entry at $60 is finally in the green. Still a great long-term buy for dividend investors.

📉 Portfolio Adjustments — What I Bought & Sold This Week

🔴 Sold Positions

Nvidia (NVDA) ❌ — Took a loss, expecting a pullback post-earnings

Oracle (ORCL) ❌ — Sold ahead of earnings uncertainty

Palo Alto Networks (PANW) ❌ — Overextended, locking in profits

Target (TGT) ❌ — Weak outlook, time to move on

🟢 Added to Positions

Procter & Gamble (PG) ✅ — Defensive play, now 6.48% of portfolio

Google (GOOGL) ✅ — Increased holdings to 5.06%

Novo Nordisk (NVO) ✅ — Strong growth story, now 3.94% of portfolio

Brookfield (BAM) ✅ — Waiting on earnings before adding more

🚀 New Positions

Tesla (TSLA) ✅ — Short-term trade, looking to exit on a rally

Realty Income (O) ✅ — 5.7% dividend, monthly payer, solid REIT

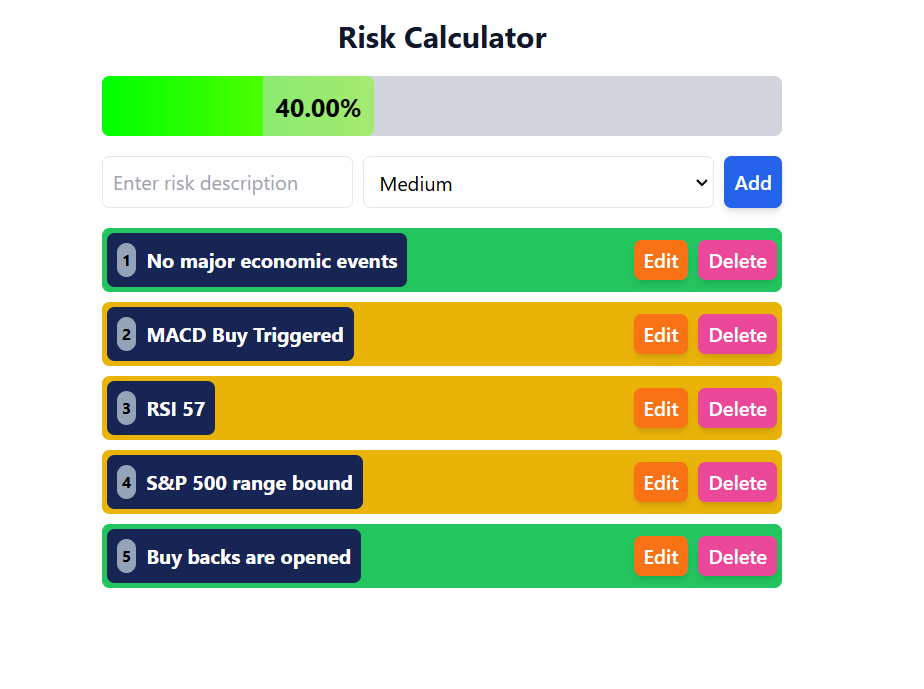

⚠ Market Risk Assessment — Should You Be Cautious?

📅 Key Economic Events Next Week:

Wednesday: Fed Meeting Minutes (FOMC)

Friday: Existing Home Sales Report

📉 S&P 500 RSI: 57 (Moderate risk)

📊 MACD: Buy signal triggered

🔄 Stock Buybacks Open: Positive for market stability

💡 Risk Level: 40% (Medium-Low) → The market remains range-bound, waiting for a catalyst.

🔥 Final Thoughts: Should You Buy Intel, CVS, or Hims & Hers?

📌 Intel (INTC) — HOLD (Watching for a pullback)

📌 Hims & Hers (HIMS) — SELL (Overbought, looking for re-entry)

📌 CVS Health (CVS) — BUY (Solid earnings & long-term value)

💬 What’s your market outlook? Drop a comment below!

🚀 Subscribe for weekly stock market insights! Stay safe and trade smart!

Share this post